Choosing the correct payment processor for a high-risk business is a significant decision that should not be rushed. It is crucial to select a processor that comprehends your specific requirements and supports the growth of your business among the numerous options available. This practical guide aims to assist you in maneuvering through the process.

Running a high-risk business, such as those in industries like supplements, adult content, or e-commerce, may not be best served by mainstream payment processors. Companies such as PayPal and Stripe, though widely used, might not be the most suitable for high-risk businesses and could lead to encountering hidden fees, fund holds, or sudden account closures. It's advisable to seek out a payment processor that specializes in high-risk industries. Processors like PaymentCloud or Durango Merchant Services are familiar with the unique challenges your business may face and offer tailored solutions to help you succeed without unnecessary complications.

Remember this information: High-risk industries often experience a higher number of chargebacks. Although they can't be completely eliminated, effective management tools can help handle them better. Certain payment processors provide services such as chargeback alerts and resolution to prevent costly disputes. Opting for a processor that offers chargeback management, fraud prevention, and early alerts can have a significant impact. These services can ensure your business operates smoothly and avoid worrying about frozen accounts due to chargeback surges.

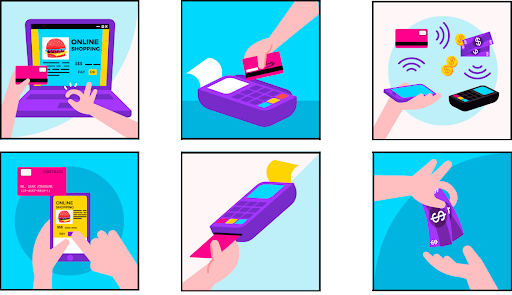

Adaptability is crucial, particularly for businesses operating on a global scale. You will require a payment processor that can handle multiple currencies, provide diverse payment options (such as credit cards, ACH, or even cryptocurrency), and allow for personalized transaction limits.By having these choices, you can ensure that your customers can effortlessly complete their purchases, regardless of their location or preferred payment method. It is crucial to select a payment processor that can scale alongside your business rather than one that restricts your potential.

Every company aims to control expenses, but industries with higher risk levels typically encounter elevated processing charges, which can range from 3% to 6% per transaction. Some payment service providers might present lower rates initially, but undisclosed fees and fines could result in higher overall costs in the future.Transparency is crucial. It's important to ensure that the payment processor is clear about all charges, such as setup expenses, monthly fees, and any potential fees for ending the contract early. A transparent pricing structure will enable you to plan and allocate funds accordingly, avoiding unwelcome surprises in the future.

Dealing with a high-risk business means that unexpected problems can come up, and having reliable customer support is crucial in these situations. Whether it's a technical issue, a chargeback problem, or frozen funds, it's important to have a payment processor that provides responsive, round-the-clock support.

Some payment processors also offer a dedicated account manager to address the specific needs of your business. This personalized assistance can help you save time and avoid frustration when urgent issues arise, giving you the assurance that help is readily available with just a phone call.

Be sure to verify the reputation of the payment processor in addition to relying on their claims. Seek out reviews and testimonials from other high-risk businesses. Are there recurrent reports of delayed payouts? Is the customer service considered untrustworthy? Opt for a payment processor with a solid reputation and favorable feedback from similar businesses. It's best to avoid a processor that can hinder your cash flow or doesn't offer prompt support.

At Offshore Unipay, we provide innovative and reliable payment processing solutions tailored to your needs. Contact us to learn more about our services, get updates, or discuss your specific requirements. We're here to help your business succeed with excellence and innovation.

Want to get in touch? We'd love to hear from you. Here's how you can reach us.