Choosing the right payment processor for a high-risk business is not just a technical decision—it directly affects your cash flow, customer experience, and long-term growth. The wrong processor can lead to frozen funds, sudden account shutdowns, or excessive chargeback penalties.

If you operate in a high-risk industry like supplements, CBD, adult services, travel, gaming, forex, or high-volume e-commerce, this guide will help you make a safe, profitable, and scalable choice.

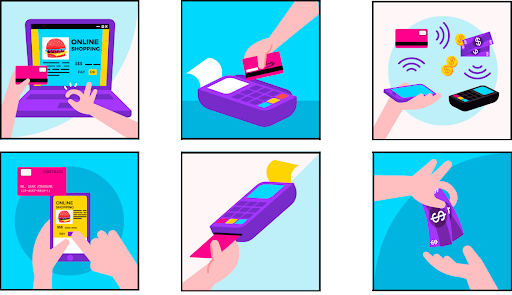

A high-risk payment processor is a provider that works with industries banks typically avoid due to:

Unlike standard processors, these providers understand risk mitigation and compliance, allowing your business to process payments without interruptions.

One of the most common mistakes high-risk businesses make is relying on generic payment processors. These platforms are not designed to handle industries with higher chargeback rates or regulatory complexity, which often results in unexpected account freezes, delayed payouts, or sudden terminations.

Instead, it’s important to work with a payment processor that specializes exclusively in high-risk businesses. Such providers understand industry-specific risks, apply proper underwriting, and offer customized solutions. This ensures smoother payment processing, higher approval rates, and long-term account stability—without unnecessary interruptions to your cash flow.

Choosing the right specialist allows you to focus on scaling your business while your payments remain secure and compliant.

High-risk businesses naturally face higher chargeback rates. While chargebacks can’t be eliminated completely, poor management can destroy your account.

Must-have chargeback features:

A good processor helps you stay below critical thresholds, protecting you from:

Your customers expect fast, convenient, and familiar payment options. Limited payment methods mean lost sales.

Look for processors that support:

If you sell globally, multi-currency and local payment support can increase conversions by 20–30%.

The right processor should scale with your business, not restrict growth.

Yes, high-risk payment processing costs more. Typical rates range between 3%–6% per transaction, depending on risk level.

Beware of:

Ask for clarity on:

A transparent pricing model helps you forecast expenses and protect your margins.

In high-risk processing, issues are not “if” but “when”.

You need:

Bonus advantage:

Some processors assign a dedicated account manager, which can:

When funds are frozen or transactions fail, minutes matter.

Never rely only on sales promises.

Before signing, check:

Red flags to avoid:

A processor with a strong reputation among high-risk merchants is worth the investment.

For high-risk businesses, the goal is not just processing payments—it’s processing them safely, consistently, and at scale.

The right high-risk payment processor will:

If you’re serious about building a sustainable high-risk business, choose expertise over convenience.

If you want personalized recommendations, industry-specific guidance, or help comparing providers, reach out today and get expert support tailored to your business model.

Your growth depends on the processor you choose—make it the right one.

A high-risk payment processor helps businesses in high-risk industries accept online payments securely without sudden account freezes or shutdowns.

High-risk specialists reduce the risk of fund holds, chargeback penalties, and account termination—helping your business grow safely.

Yes. High-risk processors use customized underwriting, which significantly improves approval rates for restricted industries.

Most high-risk merchant accounts charge 3%–6% per transaction, with transparent pricing and no hidden fees.

Yes. Reputable high-risk processors prioritize payout stability and compliance, reducing the chances of frozen funds.

Absolutely. High-risk processors support global payments, helping you reach more customers and increase conversions.

Yes. They support recurring billing, automated payments, and flexible billing cycles for subscription businesses.

Most applications are approved within 2–7 business days, allowing you to start accepting payments quickly.

They offer fraud prevention tools, chargeback alerts, and dispute management to protect your merchant account.

Yes. A reliable high-risk processor provides stability, scalability, and higher conversion rates as your business grows.

At Offshore Unipay, we provide innovative and reliable payment processing solutions tailored to your needs. Contact us to learn more about our services, get updates, or discuss your specific requirements. We're here to help your business succeed with excellence and innovation.

Want to get in touch? We'd love to hear from you. Here's how you can reach us.